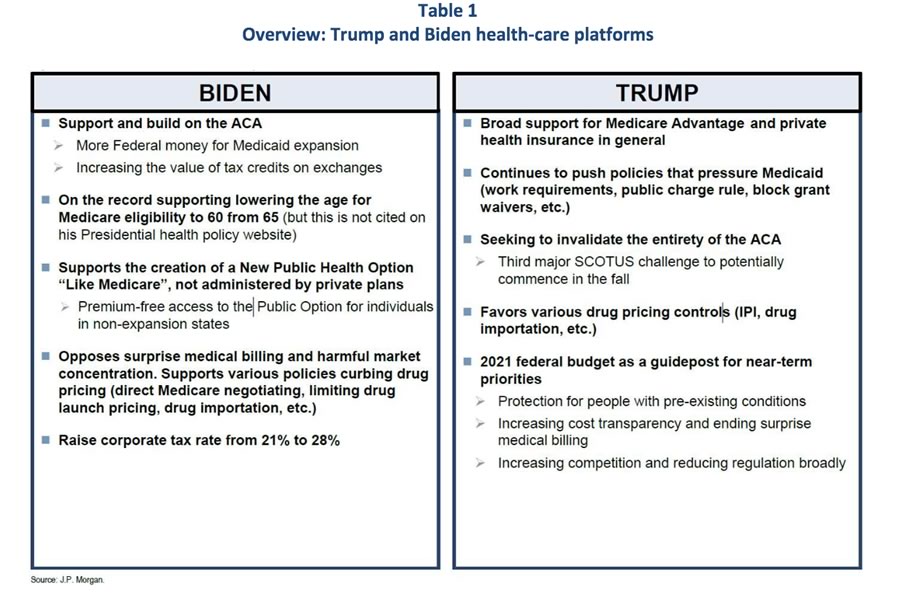

When looking at the competing priorities related to health-care reform between Donald Trump and Joe Biden, what is most striking is the degree of overlap. Both want to address surprise billing. Both want to allow drug reimportation. Both are considering an international reference price scheme. Both seek to reduce individuals’ out-of-pocket expenses. The means of getting to these outcomes are somewhat different, but the themes are consistent. The one area of prominent difference between the two relates to health insurance. While Trump would still like to dismantle the Affordable Care Act, Biden wants to expand it.

From an investing standpoint, at Coho Partners, we believe it is important to not get lost in the weeds on political and regulatory issues and instead, to focus on the big picture. What hasn’t changed with regard to health-care reform is this: it’s hard. That Obamacare got across the finish line is an impressive feat. Yet even this sweeping change was legislated in a manner that left most of the existing health-care system intact, proved quite manageable for the majority of health-care companies, and created a windfall for some. Regardless of who wins the White House (or the Senate or the House) in November, we believe that may largely be the case again.

Whatever health-care legislation does get passed (if any) will certainly be less disruptive to the companies we own than the introduction of the Affordable Care Act(ACA).

On insurance reform, we see most scenarios benefitting the managed-care providers owned in the Coho portfolio such as UnitedHealth Group(UNH)and CVSHealth Corporation(CVS). Trump is pushing Medicare Advantage which should continue to be a meaningful growth driver regardless of the election outcome. Biden’s plan to lower the Medicare age to 60 from 65 and introduce a public option could also be a net positive. The age reduction should be additive to Medicare Advantage growth. A public option would have limited negative impact as its main intent is to provide coverage for those lacking it in states that did not expand Medicaid under the ACA. While a public option could take market share from commercial insurance, we note that there is already a public option for those over 65 –Medicare. Yet the growth and market share gains in that market are in Medicare Advantage, i.e. the plans administered by private insurers.

The risks on the drug pricing policy side are trickier. There is nothing particularly novel in any of the proposals put out by either of the candidates. Reimportation and international reference pricing have been floated numerous times over the prior couple of decades, and for various reasons, always fade away. If we assume this time is different, and that legislation is passed, we believe international reference pricing would be more onerous to the pharma and biotechnology industries than drug reimportation. Not only would it effectively end price increases, it could also lead to downward drug price volatility due to differing patent expiration timelines, generics, and the reference countries’ own price reference rules. These are some of the sticking points that cause reference pricing to be easy to talk about in theory but difficult to implement in practice.

One thing is certain, the drug industry lobby is powerful and effective. Additionally, the pharmaceutical industry is prudent at self-policing. In the end, the goal is to lower drug prices with a focus on out-of-pocket costs for consumers. In response to Trump’s threatened executive orders just a few months ago, the pharma industry countered with a proposal that would increase the cost savings above the level identified in the Trump plan. More broadly, the industry realizes that price cannot be a growth driver going forward. Instead, truly innovative, novel therapeutics that address unmet medical needs are the key to expanding sales and earnings. As evidence of this understanding,Table 2 below shows that net price increases for the pharma industry have been trending lower for the past four years and were only about 1% in 2019 (Table 2).

For our portfolio companies, Amgen(AMGN), Johnson & Johnson(JNJ), and Merck & Co.(MRK), net pricing was negative in 2019. And those companies are delivering the novel medicines that will be reimbursed regardless of drug price reform. JNJ has introduced more new molecular entities over the past decade than any other pharmaceutical company. MRK introduced what could become the most successful drug in history in Keytruda to combat numerous cancers. Amgen’s pipeline contains promising new oncology treatments, as well.

If drug price reform were successfully passed in a meaningful way, it could lead to drug price deflation theoretically pressuring service providers like pharmacy benefit managers (UNHand CVS have exposure) and drug distributors such as AmerisourceBergen (ABC). However, these companies have increasingly moved away from a dependence on drug price inflation already. For example, in the case of ABC, 95% of its branded drug contracts are fee-for-service. As in the past in these industries, any material regulatory change may lead to re-contracting to ensure they continue to get adequately compensated for their services. The companies will also point out to regulators that they have been integral in driving the decline in drug price inflation observed in recent years.

Along those same lines, the breadth and extent of the response to the COVID pandemic throughout the health-care ecosystem is creating significant goodwill for the industry. We have had multiple conversations with our portfolio companies where this sentiment was echoed while noting that conversations between the industry and regulators have become more productive and congenial. Should a vaccine be successfully developed and approved within the next few months, this goodwill will likely expand and continue to take some pressure off the industry.

Health care is always an area of focus for regulators and politicians. That focus is heightened in election years. In our view, the current reform proposals from both sides of the political aisle are manageable for the health-care companies within the Coho portfolio and could be beneficial to some. Our allocation within the Health Care sector is concentrated in companies bringing true innovation to the market and those working to help lower health-care costs. We firmly believe that introducing products that address unmet medical needs will continue to be reimbursed at rates that provide attractive returns for the companies and shareholders alike regardless of how the health-care system evolves. Additionally, companies focused on removing costs from the system and providing care more efficiently are critical to the transformation of the health-care system and should remain integral to the delivery of care going forward. We seek to identify these types of companies for the Coho portfolio while investing at appropriate valuations to help ensure our ability to meet our goal of protecting our clients’ principal. The health-care stocks in the portfolio today carry a lower average P/E ratio, a higher average dividend yield, and a favorable forward earnings growth rate relative to the S&P 500 Index. In our view, innovation, an ability to bend the cost curve, and attractive valuations should combine to provide compelling returns under almost any political regime.

We will continue to monitor policy changes as they occur, and as always, will seek to reduce risk in the portfolio should any point to a more material impediment to the sustainable and predictable revenue and earnings growth we seek for our companies.