September furthered the third quarter’s advance with the S&P 500 Index rising 0.6% and the S&P 500 Value Index up 0.4%. The portfolio posted an increase of 1.4% as the month had a defensive tilt.

For the quarter, the S&P 500 and S&P 500 Value rose 7.7% and 5.9%, respectively, while the portfolio advanced 6.7%. All sectors posted a positive return but there was a fair bit of dispersion with Health Care being the best sector (up 14.5%) and Materials being the worst (up only 0.4%).

For the year-to-date period, the portfolio continues to lag the S&P 500’s gain of 10.6% by about 2.9% but it is outpacing the S&P 500 Value’s return of 3.5% by about 4.2%. Our underperformance relative to the S&P 500 is almost entirely explained by our underweight in Information Technology, which, as a sector, is up 25% over this period, and our overweight to Consumer Staples, which is actually down 3.7%.

All of our third quarter trading activity occurred in September. We trimmed Dollar General, due to valuation and position size as it had become our largest holding. The company’s stock has appreciated 40%+ over the trailing year, and its prospective expected rate of return is now lower, but still attractive. The company continues to execute nicely, and we remain favorably disposed to the dollar store business model which has historically shown a great combination of defensive strength in a weak economy along with long-term earnings prospects greater than the market. We also trimmed Kroger, which has been a holding that has generated a lot of conversation. We added to our position in 2017 when the Amazon threat was perceived to be a death knell for Kroger and that addition in the low $20 range proved timely as our recent trade reduced the position size at a share price around $32. We added to the ConAgra position we initiated in the first quarter because the stock price has barely moved as we have gained even more confidence in CEO Sean Connelly’s vision within frozen foods and snacks. Finally, having reduced our State Street position in the first quarter at prices well over $100, we had the opportunity to add back to this well-run company when it announced its intention to acquire Charles River. We believe this deal will further strengthen the company’s offerings to its sophisticated client base and, with the stock back down to the mid $80s, the risk/return profile became quite attractive again. All of the trades were valuation driven. We were able to reduce positions in companies that have performed well and expected future rates of return have decreased while adding to companies that are executing well but whose stock prices are flat to down, and whose valuations are not capturing the strong fundamentals.

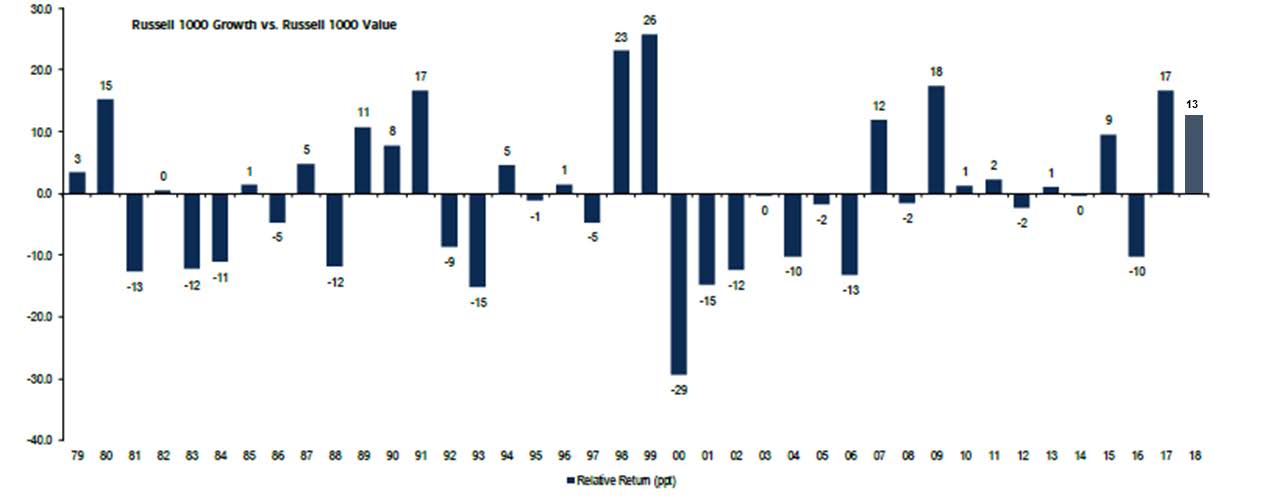

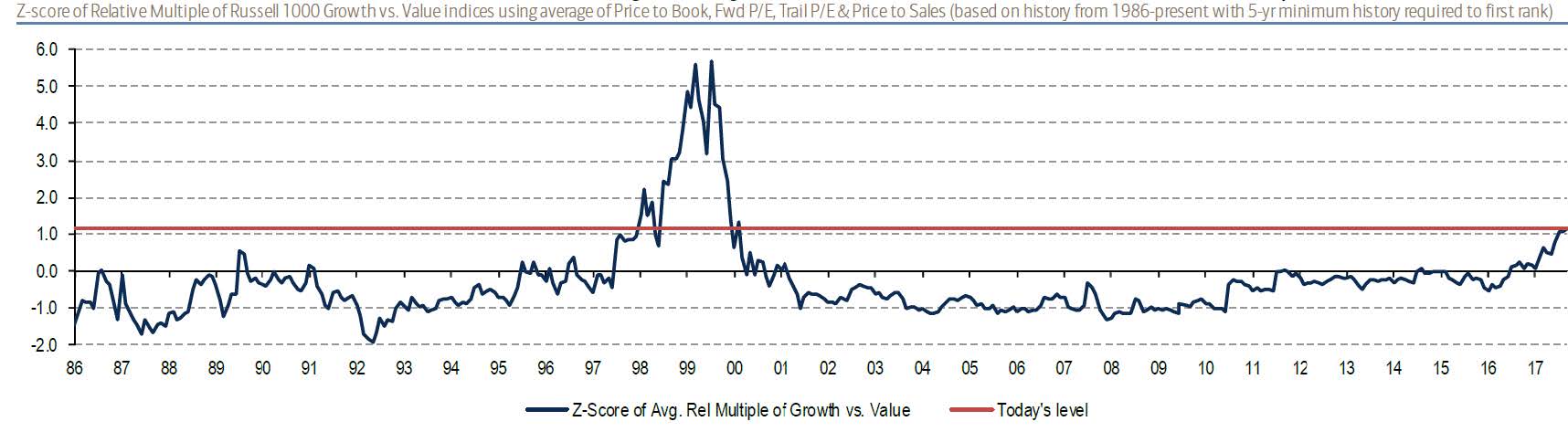

Regarding the broader market, Chart 1 shows a nearly 40-year history of the performance of “growth” versus “value.” For the period from 1979 through 1997, “growth” and “value” seesawed back and forth with the two styles eventually having similar returns. The two-year period of 1998 and 1999, shows “growth” dramatically outperforming “value” as the dot-com period favored growth stocks, particularly Technology. However, the “value” style had a strong bias for the next seven years, which more than offset growth’s advantage during the dot-com period. Since 2007, “growth” has clearly outperformed “value” and valuations for growth relative to value are higher than any time outside of the Tech bubble of the late 1990’s (Chart 2, below).

Chart 1

Russell 1000 Growth vs Russell 1000 Value Returns

Source: Russell, BofA Merrill Lynch US Equity & US Quant Strategy

For illustrative purposes only.

Chart 2

Russell 1000 Growth vs. Russell Value Relative Valuation

Source: BofA Merrill Lynch US Equity & US Quant Strategy, FactSet, FTSE Russell

For illustrative purposes only.

The year-to-date period has also been marked by a number of major market bubbles. We would note the unwinding of the Bitcoin craze, which saw the price of Bitcoin rocket from less than $900 in January of 2017 to nearly $20,000 by the end of that year before crashing back to about $6,600 recently. Lately, we have seen the mania surrounding cannabis create some major volatility. The poster child would be Tilray, Inc., a Canadian company that engages in research, cultivation, production and distribution of medical cannabis. In August, this company traded at about $20 a share but, in September, it spiked to over $300 before rapidly collapsing to $143 by the end of the month. At its peak, Tilray had a market capitalization of nearly $23 billion on estimated 2018 sales of less than $50 million. This reminds us that investors can get caught up in crazes and lose focus on valuation. At Coho Partners we seek business models that are enduring, with consistent earnings and dividend growth, and where the valuations are reasonable. We are essentially “partnering” with the managements of these companies to understand their long-term operating and financial strategies, which we believe we can monitor on an ongoing basis via a conservative dividend discount valuation methodology. This process has proven successful in the past, and we believe it will do so in the future.

Part of our process is to define sectors as either being “demand defensive” or “economically sensitive.” Demand defensive sectors tend to include companies whose business models are reasonably well-insulated from gyrations in the economy. Economically sensitive sectors contain businesses whose fortunes are much more tied to changes in the economy. Thus, their earnings tend to be much more volatile. To us, demand defensive sectors are Consumer Staples, Health Care-related issues, Integrated Energy, Telecommunications, and Utilities. Everything else is “economically sensitive” and much more impacted by the cycle. However, in September, a number of large and well-known companies were reclassified by S&P from Information Technology, Consumer Discretionary and Telecommunications to an entirely new sector called Communications Services. The old Telecommunications sector is no more. The new Communications Services sector still has the three legacy telecommunications companies in it, but some of the larger additions include Facebook and Alphabet (Google) from the Information Technology sector and Comcast, Disney, and Netflix from the Consumer Discretionary sector. The characteristics of this new sector are dominated by the non-telecom issues with Alphabet, Facebook, and Netflix accounting for over half of the overall weight.

Telecom had historically been a demand defensive sector for Coho but with this new sector now dominated by more cyclical issues, it seems to make sense to count the entire Communications Services sector as economically sensitive. Even the legacy Telecom group is not what it used to be with AT&T owning and/or chasing media companies instead of just being a service provider. The new group will have approximately a 10% weighting in the S&P 500 with just 2% being the legacy telecom stocks (Verizon, AT&T, and CenturyLink.) Despite these reclassifications, there will be no impact to the way we go about creating our investable universe.

The views, opinions, and content presented are for informational purposes only. They are not intended to reflect a current or past recommendation; investment, legal, tax, or accounting advice of any kind; or a solicitation of an offer to buy or sell any securities or investment services. Nothing presented should be considered to be an offer to provide any Coho product or service in any jurisdiction that would be unlawful under the securities laws of that jurisdiction. Past performance is no guarantee of future results. There can be no assurance that the portfolio will be successful in limiting volatility.