Third Quarter 2019

participate in an advance while also

providing downside protection.”

Despite mixed economic data, increased geopolitical tensions, and the initiation of impeachment proceedings against the President, domestic equity markets reversed their August declines and resumed their march higher in September with the S&P 500 Index advancing 1.9% and the S&P 500 Value Index rising 3.7%. The returns this month pushed both indices into positive territory for the quarter with the S&P 500 Index up 1.7% and the S&P 500 Value Index returning 2.8%. The return for the Coho Relative Value Equity portfolio this month was 2.0%. For the quarter, Coho’s performance finished between the two benchmarks at 2.4%.

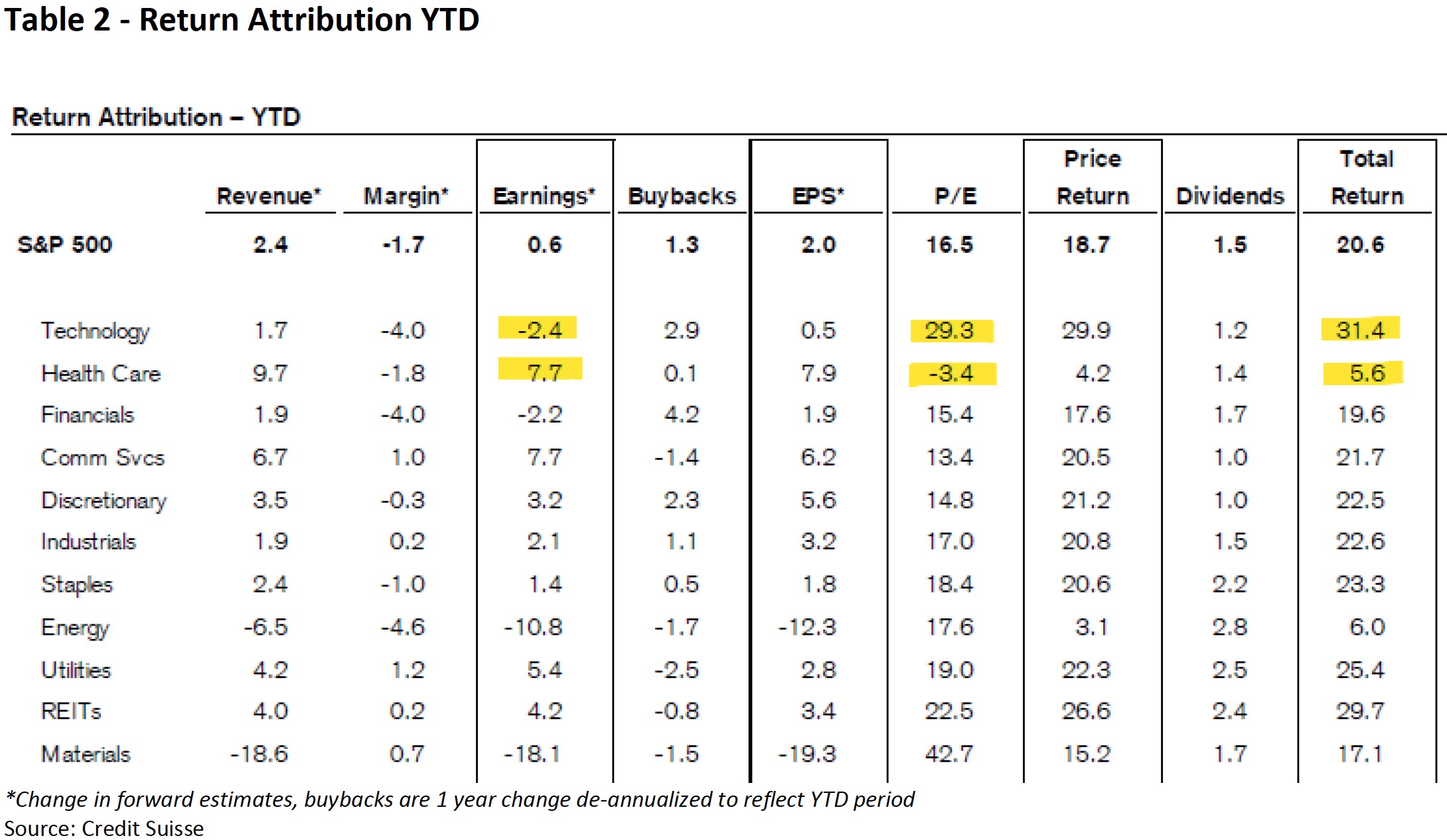

Last quarter we spoke to the headwinds confronting the portfolio in the first half of the year including a strong cyclical tilt, growth dominating value, and Information Technology leading the market to its best six-month return in more than 20 years with Health Care the biggest laggard. While that backdrop remains in place year-to-date, there was some respite to several of those trends this quarter and that is reflected in the improved relative returns for the Coho portfolio. Nevertheless, the S&P 500 Index and S&P 500 Value Index are both up more than 20% year-to-date, the Technology sector continues to lead with returns exceeding 30%, and Health Care remains near the bottom, up only 5%. This quarter also saw leading performance from interest rate sensitive sectors we tend to avoid like Utilities and Real Estate as the Federal Reserve began cutting interest rates for the first time in ten years. This helped drive performance for both value indices and “low-vol” strategies that are exposed to these high yield sectors.

Our underweight to Technology and overweight to Health Care remained a headwind from an allocation perspective in the third quarter, but stock selection was positive thanks in part to nice rebounds in some of our year-to-date laggards. For the quarter, CVS Health and Kroger rose nearly 17% and 20%, respectively, and State Street was up 6.5%. These moves reinforce our conviction that strong and improving fundamentals are eventually rewarded by the market, and when expectations are low, those reversals in performance can be meaningful and quick.

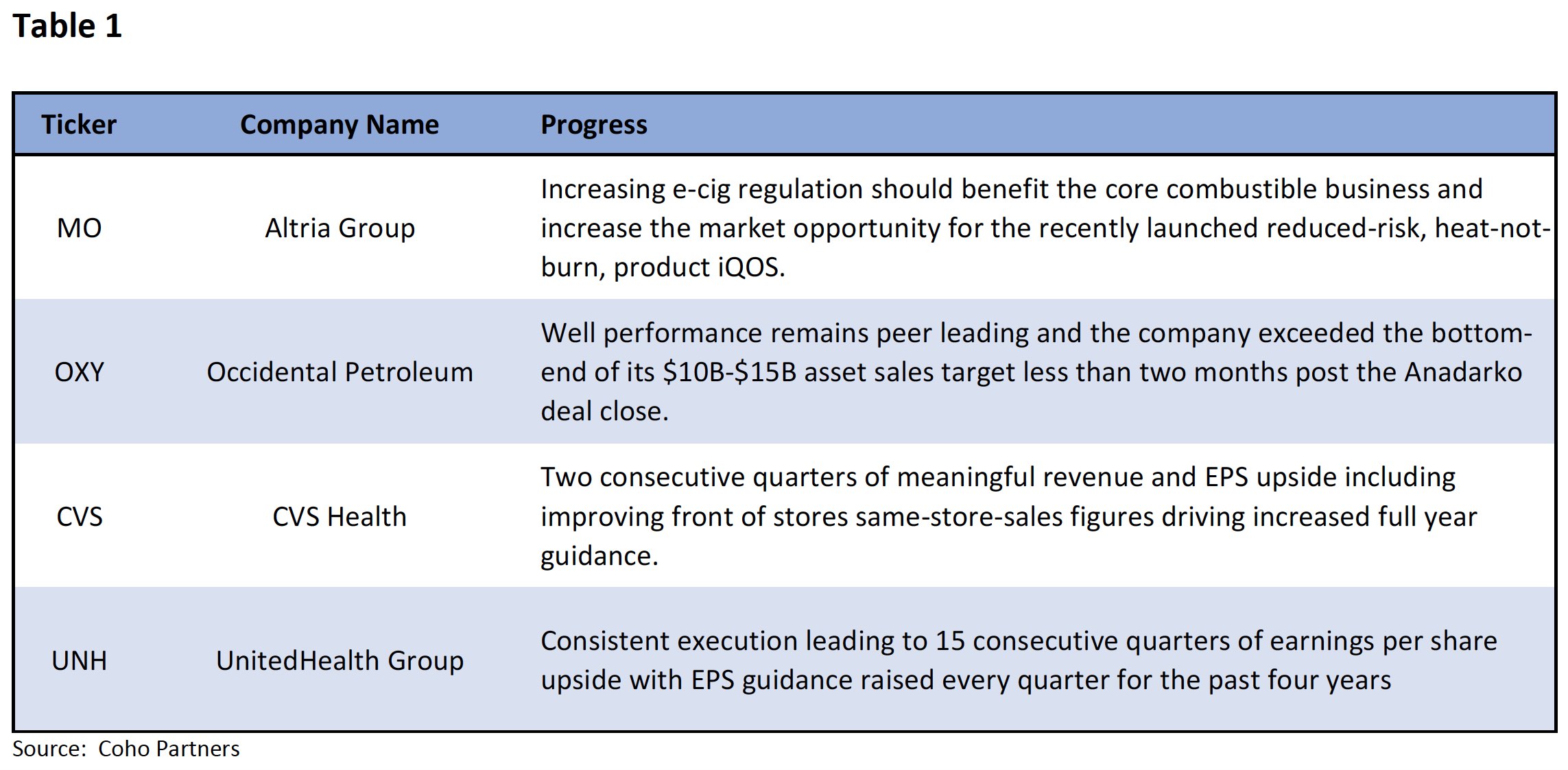

While it is encouraging to see the turn in performance for those stocks, there are still several positions in the portfolio that are being pressured by various market concerns. Altria Group has detracted from results on concerns over declining combustible tobacco volumes and its investment in JUUL. Occidental Petroleum’s acquisition of Anadarko Petroleum was not well received due to the additional assumed debt related to the deal. Within Health Care, similar to CVS Health, UnitedHealth Group has been pressured by political rhetoric including Medicare-for-All concerns.

Performance for these stocks has been challenging so far this year, but we believe each provides meaningful return potential. In Table 1 below we highlight what we view as measurable, but underappreciated, progress for each.

The mismatch between the fundamentals and performance for Health Care names like CVS Health and UnitedHealth Group highlights a larger sector wide trend. Table 2 below breaks down the year-to-date returns of each sector based on the contribution from earnings revisions, stock buybacks, and P/E multiple expansion/contraction. The table shows that Health Care has seen the highest level of positive earnings revisions for any sector this year yet is the only sector to have experienced P/E multiple contraction. Despite its improving fundamentals, its year-to-date returns remain at the bottom of the pack. Contrast that with the Technology sector which is the strongest year-to-date performer. Its returns have been driven almost exclusively by P/E multiple expansion as it has experienced negative earnings revisions.

The most recent earnings season was a strong one for the portfolio companies with 22 of the 28 beating consensus EPS expectations and half of those raising full-year guidance. There is a lot of uncertainty in the market, but we believe stock price performance will ultimately follow fundamentals. At Coho, our philosophy and process are rooted in a conservative, disciplined, fundamentally based valuation framework, and the portfolio remains positioned accordingly.

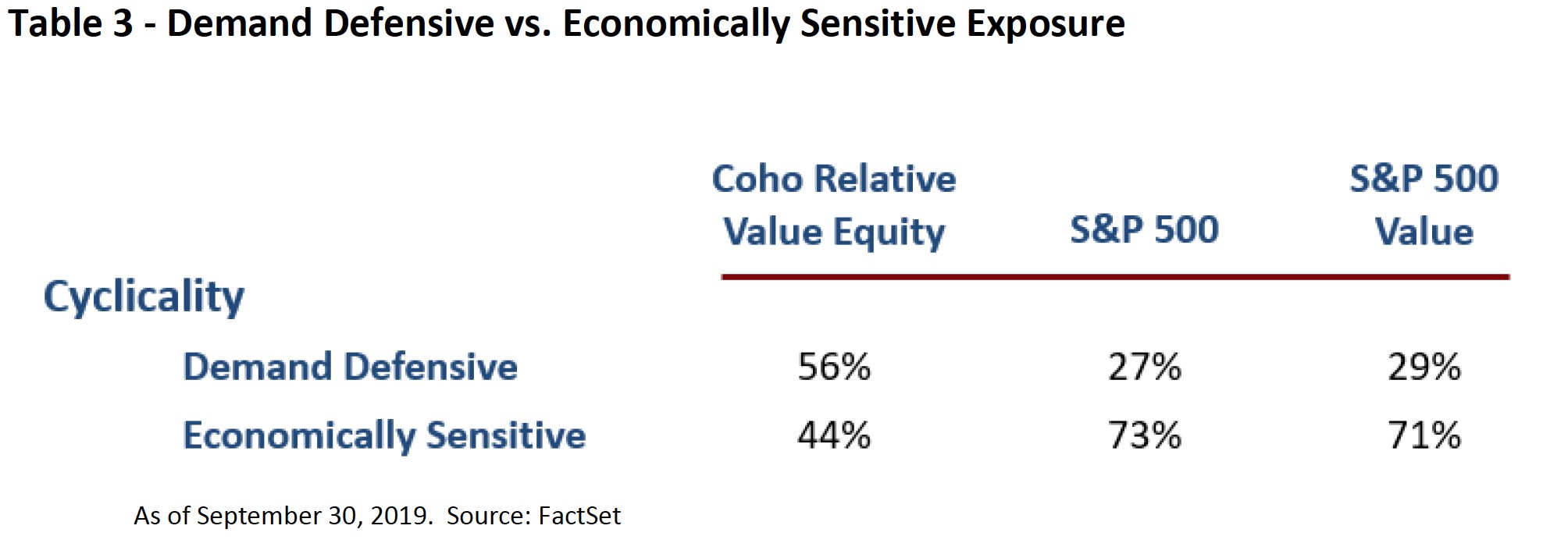

This positioning keeps the portfolio overweight the demand defensive sectors like Health Care and Consumer Staples. This is not unusual as we always lean more toward demand defensives than economically sensitive, or more cyclical sectors, given our focus on downside protection. What is unusual is the spread between the portfolio positioning and that of the market. Table 3 shows the demand defensive and economically sensitive exposure in the portfolio relative to the S&P 500 and S&P Value indices. At 56%, our demand defensive weighting is in line with our typical range; however, the demand defensive weightings for the indices have fallen to their lowest levels in more than 20 years.

While our process has remained consistent, the meaningful uptick in the cyclical allocation within the benchmarks has pushed the spread between the portfolio’s demand defensive weighting and that of the indices toward record highs. Ten years into the longest economic expansion on record, we are comfortable leaning into the wind. On a P/E multiple basis, our portfolio has historically tended to trade more or less in line with the S&P 500 Index, but it currently sits at a meaningful discount on a trailing 12-month basis (Table 4). This conservative valuation combined with the portfolio’s higher yield, higher demand defensive weight, and lower beta should all help protect principle should volatility in the markets increase.

We made several trades in the portfolio this quarter. All the sales were driven by our valuation discipline and included trims of Abbott Laboratories, Dollar General, and Global Payments, and an elimination, after nearly 20 years of ownership, of the Automatic Data Processing position. We used part of those proceeds to add to UnitedHealth based on our conviction that political rhetoric and headlines are driving the stock rather than fundamentals which remain strong. We also initiated positions in two new stocks: Unilever and Stanley Black & Decker. Unilever should continue to benefit from its exposure to faster growing emerging markets and margin opportunities in its home care and food segments. Stanley Black & Decker is a leader in the hand-held and power-tools market with a broad product line spanning all end markets from DIY to professionals. It has visible growth drivers through a pipeline of new product introductions and the relaunch of the Craftsman brand.

Importantly, these trades improved the valuation of the portfolio, increased the dividend yield, lowered the beta, and raised the demand defensive weighting. As we enter the fourth quarter of 2019, we view the current portfolio positioning and valuation as particularly compelling. The S&P 500 Index is moving into the final quarter with its best year-to-date gain in more than 20 years and a record high exposure to cyclicality. While the portfolio is lagging in this strong year-to-date market, we remain firmly committed to our investment process and philosophy—one that focuses on downside protection and upside participation. Strong fundamental performance of the stocks in the portfolio should be rewarded with commensurate price performance and allow it to participate should markets continue to rise. The predictability and stability of these companies coupled with lower cyclical exposure and a meaningful valuation discount should provide good downside protection if the market corrects.

If you have questions or concerns about our outlook or the portfolio’s positioning, please do not hesitate to call us. We look forward to updating you on the progress of the portfolio as the year progresses.

Sincerely,

Coho Partners’ Research Team

The views, opinions and content presented are for informational purposes only. They are not intended to reflect a current or past recommendation; investment, legal, tax, or accounting advice of any kind; or a solicitation of an offer to buy or sell any securities or investment services. Nothing presented should be considered to be an offer to provide any Coho product or service in any jurisdiction that would be unlawful under the securities laws of that jurisdiction. Past performance is not indicative of future results.